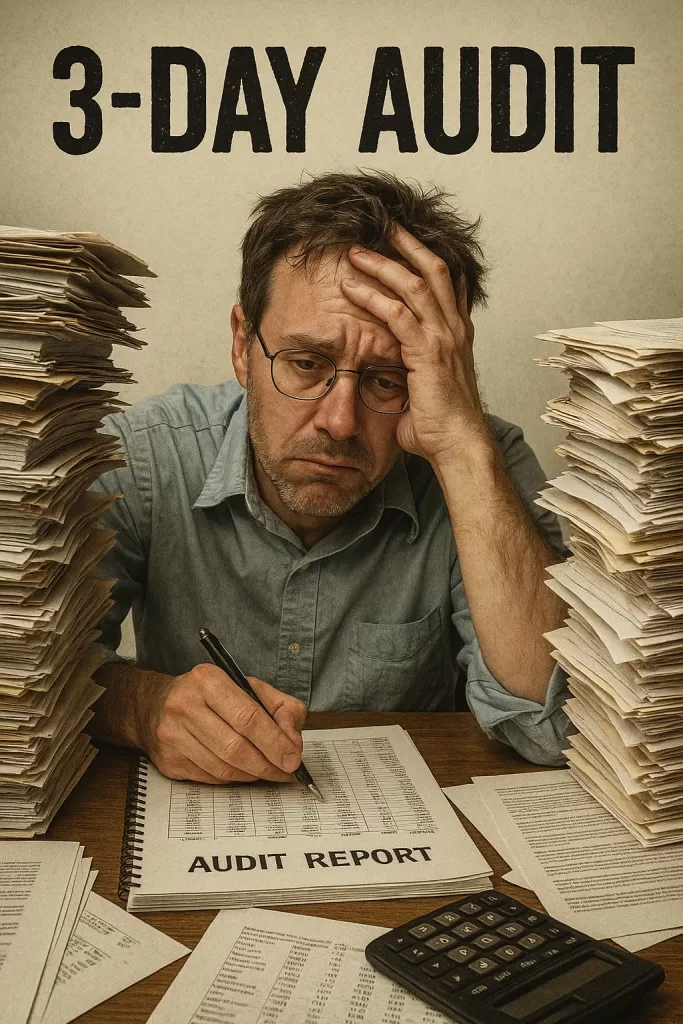

Lately, I’ve been observing a growing trend where Financial Institutions (Banks and NBFCs) are increasingly mandating 3-day onsite audits as part of their Third-Party Risk Management (TPRM) programs. It often feels like an implicit signal that they don’t fully trust the fintechs or startups they work with, even those that proudly hold ISO 27001 or SOC-2 certifications. These certifications were meant to demonstrate a baseline of security maturity and due diligence, yet they’re being treated more like a footnote than a foundation.

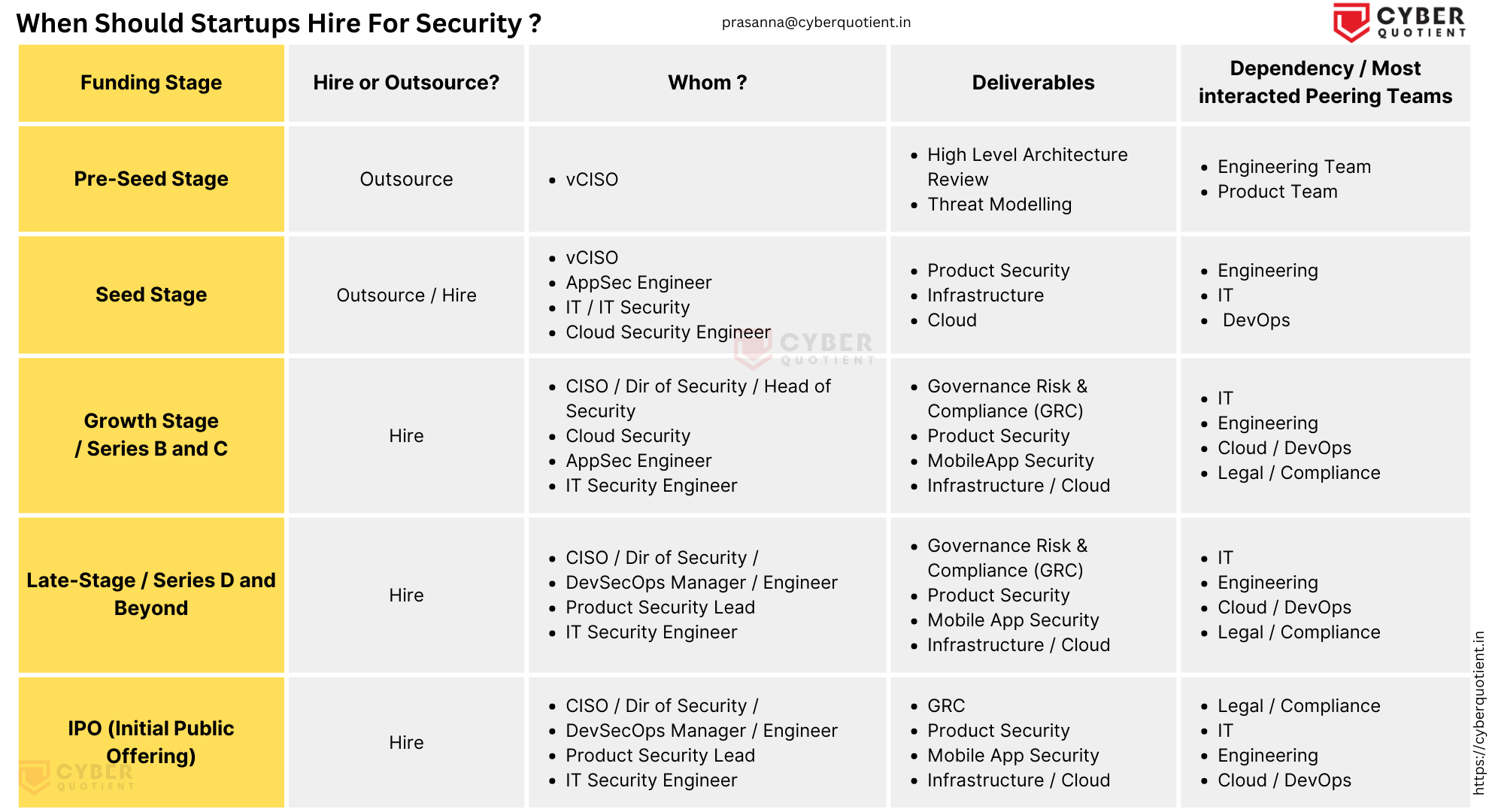

Now, if you’re a fintech or startup working with even a moderate number of financial partners, say 8 to 10, your security and GRC teams could be spending upwards of 30 working days a year managing these TPRM audits. That’s nearly a month of valuable bandwidth lost to redundant assessments and fragmented processes.

To make matters even more tangled, there’s no standard playbook across auditors. Some send sprawling spreadsheets. Others insist on a live walkthrough with no prep and rapid-fire questions. Yet another expects you to navigate a third-party portal with its own quirks and terminology. Every new audit feels like starting from scratch.

Walkthrough-style audits, in particular, tend to be the most disruptive. They often require specific team members to join calls, explain configurations, demo access flows, or justify implementation choices. And since the questions tend to repeat across audits, these sessions end up being déjà vu for many teams, especially engineering. Their time is typically reserved for product building and problem-solving. Getting them to repeatedly field audit questions naturally creates friction between Engineering and Security, and sometimes even with the partner institutions.

On the flip side, the pressure within startups isn’t helping either. Many founders are pushing their teams: security, engineering, DevOps, legal, consultants—to rush through ISO or SOC-2 readiness on extremely tight deadlines. I’ve heard the same frustration echoed by several folks: long nights, tight audits, no breathing room. It’s become a checkbox race, not a maturity journey.

There’s also a growing school of thought within the industry that ISO/SOC-2 reports, especially the ones churned out by compliance automation platforms are becoming more of a sales enablement tool than a reliable indicator of security posture. That perception is driving financial institutions to dig even deeper during TPRM audits, essentially second-guessing the very frameworks designed to reduce the need for redundant assessments.

It’s tempting to wish for regulatory clarity here—perhaps a unified guidance from the regulator on how TPRM audits should be approached across the ecosystem. But that might be asking too much, given the operational nature of these audits and the regulator’s usual hands-off stance on implementation details.

To me, this is a multi-layered challenge. ISO and SOC-2 were designed to communicate security assurance to stakeholders for both internal teams and external partners. But if the output is no longer trusted, the entire premise starts to wobble.

As a small experiment, I once created a detailed Security Handbook for a client I consult for as a vCISO. It outlined their security practices end-to-end and drastically improved our turnaround time for security questionnaire responses. But unfortunately, the auditors weren’t too pleased—they preferred their own templates, their own questions, their own format. It didn’t matter that the answers were clear and well-structured. Standardization was nowhere in sight.

And let’s not ignore the irony where auditors are still asking for screenshots in an age where APIs could provide real-time evidence. It just feels out of sync with the pace and capabilities of modern tech. Honestly, this entire space is long overdue for disruption.

So the question is “how do we solve this?” What’s a practical, scalable way to balance assurance demands with the productivity of already stretched teams? How do we rebuild trust in certifications without burning out people in the process?

Would genuinely love to hear your thoughts.