NOTE: I had published this article first here on Medium

I think when it comes to Privacy for Indian Citizens, the old adage “choosing between the Devil and the Deep Blue Sea” seems to hold true.

On one hand our Government is stripping privacy of citizens part by part by linking Biometrics with everything ranging from Airport to Stadium entry.

On the other hand we have to deal with sheer incompetency shown by the same Government Agencies that are supposed to keep the above data secure, are instead leaking them left, right and centre!

Here is what happened: SEBI and MCA in their eagerness to solve the fraudulent issues surrounding unclaimed/unpaid dividends relating to stocks and mutual funds had mandated that the investor details be put on the websites of all the listed companies and Mutual Fund Houses.

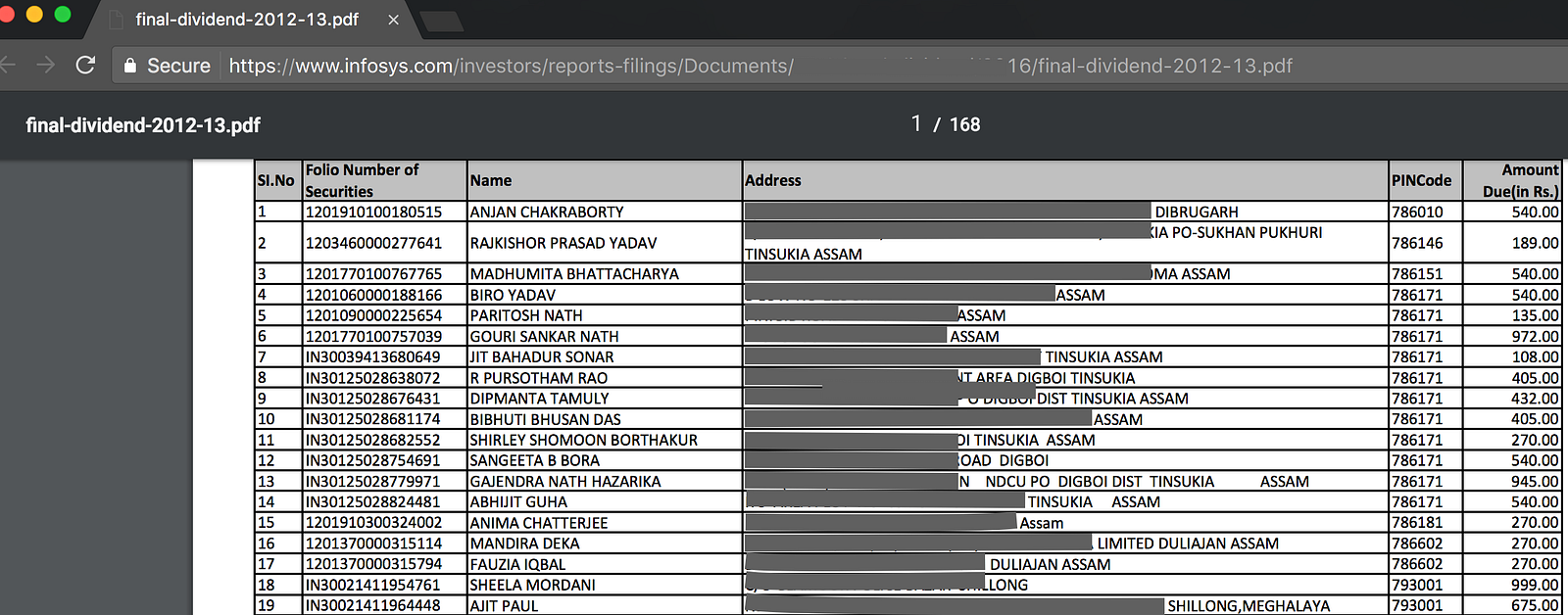

There are about 5800 Publicly traded companies at the BSE and almost every one of them have put a Spreadsheet or PDF document containing the following data accessible to the Public without any authentication or checks of any sort.

· Name of the Investor

· Address

· Name of Mutual Funds

· Amount

· Demat Numbers

· Folio Numbers

Full name and address together constitutes Personally Identifiable Information (PII). Some companies have also listed the Demat Account Numbers in addition to these Personally Identifiable Information. As these include financial information, it could be further classified as Sensitive PII. If you have ever traded for stocks on invested in mutual funds but have not received the dividends, chances are your PII may be put on website for everyone to see on the internet. Caveat: The above data is for those investors, whose bank details are not updated with the fund houses/publicly traded companies for them to transfer this money.

In my estimate, there are more than a million records of PII out there is public.

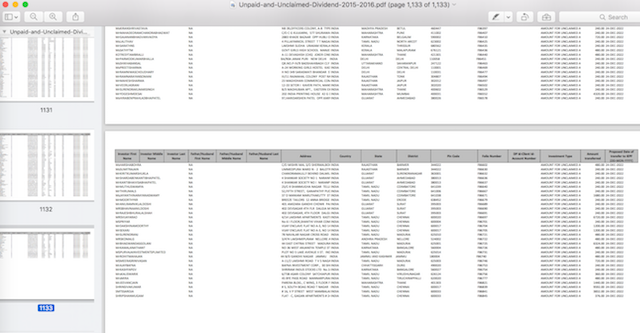

One of the file I downloaded had about 25000 entries. Yes, Personally Identifiable Information (PII) of 25,000 investors spread across not just India but different parts of the globe. This above file was for just 2015–16, all the publicly listed companies host these data from 2009! Another file from a different publicly traded company included 1100 page PDF with rows of information containing addresses, Folio numbers, Demat account numbers with names!! Here are some samples:

https://www.nmdc.co.in/Docs/Investors/Dividends/NMD_DIV23.pdf

http://3i-infotech.com/content/investors-2/details-of-unclaimedunpaid-dividend-with-the-company/

Background: The first of the notifications was made by Ministry of Corporate Affairs (MCA), Gazette of India G.S.R. 352(E) dated May 10, 2012

The Ministry of Corporate Gazette of India G.S.R. 352(E) dated May 10, 2012, notifying the Rule “Investor Education and Protection Fund (Uploading of information regarding unpaid and unclaimed amounts lying with Companies) Rules, 2012”. As per this Rule, companies have to identify and upload details of unclaimed dividend on their website.

SEBI notified a similar one in 2016 via SEBI/HO/IMD/DF3/CIR/P/2016/84 which makes it mandatory for all publicly traded / Mutual Fund houses to publish the list of the following details on their website:

“AMFI shall also provide on its website, the consolidated list of investors across Mutual Fund industry, in whose folios there are unclaimed amounts. The information provided herein shall contain name of investor, address of investor and name of Mutual Fund/s with whom unclaimed amount lies.”

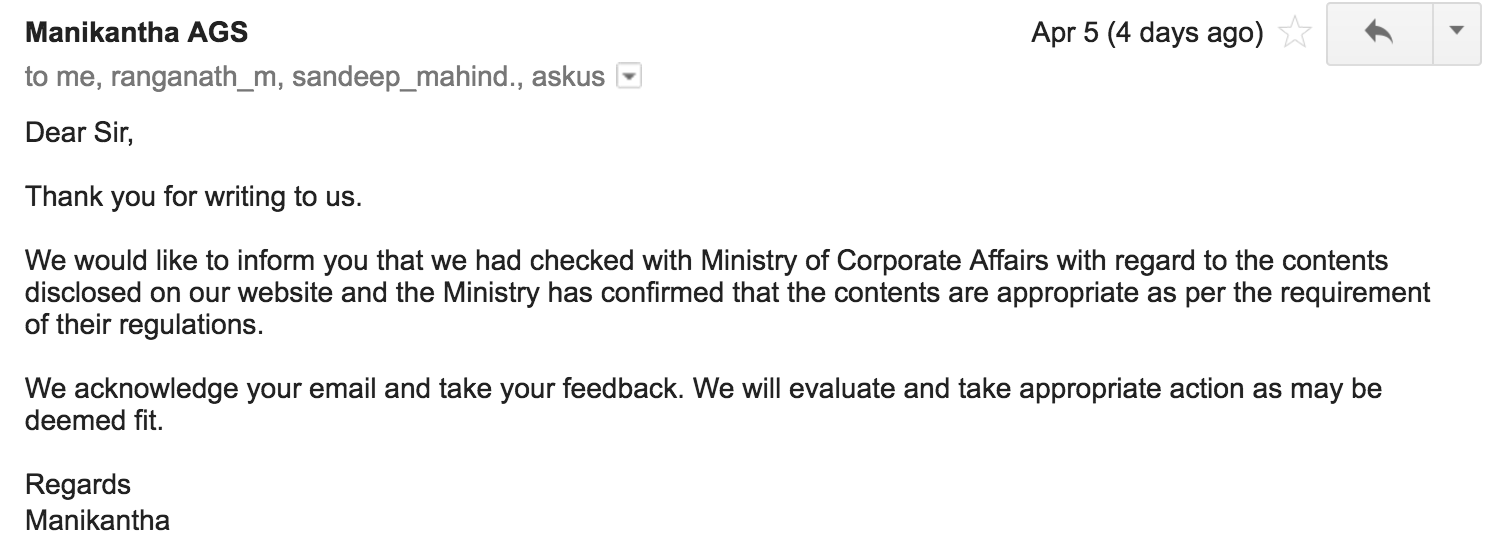

I sent out emails to many of these publicly traded companies. Except for one, nobody bothered to respond. Even when they did respond, they mentioned that they are complying by the MCA diktat.

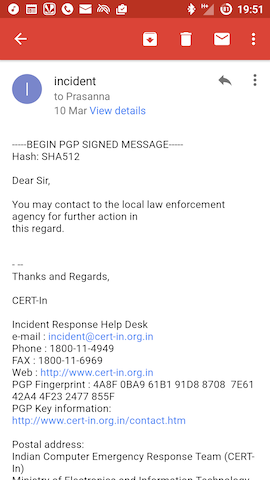

But the most callous response was from CERT-in. CERT-IN manages the Cyber Swachta Kendra which our minister launched with much fanfare and media blitz. Their response is above and you can make your opinions on how secure India’s infrastructure is going to be.

Probable Mitigation:

Instead of publicly listing the address, Demat IDs etc of people, these companies can send out the notifications to these investors. While researching on this topic I came to realise that there have been cases of some intermediaries transferring the unclaimed/unpaid dividends to themselves and it is scary to say the least. The sophistication and the amount of fraud is of unthinkable proportions. Some of the fund management companies transferred the amount to their friends, relatives while others showed it in P&L results!!

The public disclosure of addresses without the consent of the end users is violation of their privacy.

Every individual ranging from top ranked bureaucrat to minister needs to learn a lesson or two on Privacy. What is appalling is that none of the 5800 odd listed companies seem to have opposed this stupid directive. Everyone of them has complied by putting PII of its investors out there on public. I don’t know how their overseas clients are going to judge them on this.

#dividendleak #privacy #india #unclaimeddividends #millionrecords